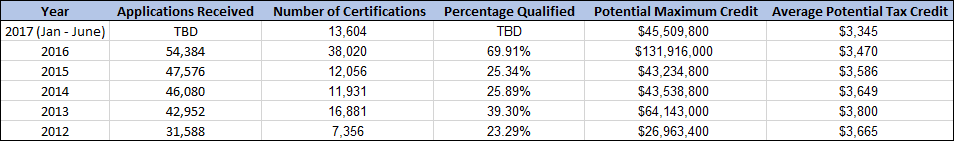

The state of Massachusetts Department of Career Services has provided CMS with its Work Opportunity Tax Credit statistics for 2012 through 2017.

Between January and June of 2017 the Bay state has issued 13,604 Work Opportunity Tax Credit certifications to employers who hired individuals from certain target groups. This puts Massachusetts on the path to issue almost $100,000,000 in tax credits this year alone.

The Department of Career Service has issued the following data:

WOTC had expired at the end of 2014, and was “on hiatus” during 2015. There was an eight month look back period in 2016.

The high average potential tax credit may reflect a lot of qualified veteran categories, or TANF recipients qualifying for a 2-year credit.

How Much We Save Employers

CMS has worked with WOTC since 1997, and we have found over the years that on average 10-15% of all new employees can fall into one of the tax credit categories that qualify for a tax credit. The average credit received is between $1,500 – $9,600 per qualified new hire depending on the target group. Some of our customers have saved a phenomenal $100,000 in a single year.

How Much Can We Save You?

To find out your potential savings, please see our WOTC Calculator. There’s never been a better time to learn about WOTC. Please contact us at 800-517-9099 to speak to a Work Opportunity Tax Credit expert today.