CMS Work Opportunity Tax Credit Newsletter August 2020

In this issue:

- Expanded Work Opportunity Tax Credit Provision in the HEALS Act

- SourceCast Selects CMS as its Work Opportunity Tax Credit Provider

- CMS Adds Increased Integration for WOTC Tax Credit to iRecruit, Applicant Tracking Software

- Understanding WOTC’s Target Groups: Summer Youth Employee

- Work Opportunity Tax Credit Statistics for Ohio

- WOTC Questions: I Only Hire Seasonally, Can I Still Use WOTC?

- Switch To Paperless WOTC Screening Today

- #ICYMI

Expanded Work Opportunity Tax Credit Provision in the HEALS Act

The HEALS Act would temporarily expand the Work Opportunity Tax Credit (WOTC) to employers hiring individuals in qualified groups, and would include a new targeted group defined as 2020 qualified COVID-19 unemployment recipients. CMS is closely monitoring the legislation, and will continue to keep you informed.

SourceCast Selects CMS as its Work Opportunity Tax Credit Provider

Cost Management Services (CMS) is excited to announce that we have partnered with SourceCast, Inc. to help their customers capture and take advantage of the Work Opportunity Tax Credit. SourceCast is a leading provider of diversity sourcing for employers, talent sources and job seekers nationwide.

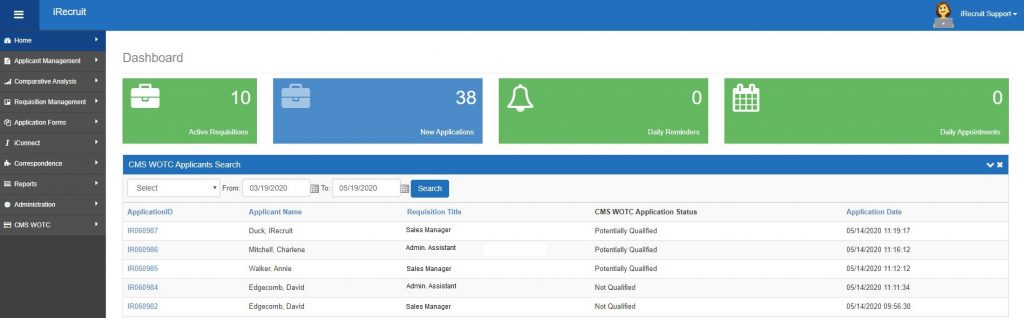

CMS Adds Increased Integration for WOTC Tax Credit to iRecruit, Applicant Tracking Software

We are pleased to announce that we have added increased Work Opportunity Tax Credit integration into iRecruit. The integration is immediately available for customers who use both iRecruit and CMS’s Work Opportunity Tax Credit Administration services.

Understanding WOTC’s Target Groups: Summer Youth Employee

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #6 is the Summer Youth Employee.

A “qualified summer youth employee” is one who:

- Is at least 16 years old, but under 18 on the date of hire or on May 1, whichever is later, AND

- Is only employed between May 1 and September 15 (was not employed prior to May 1st) AND

- Resides in an Empowerment Zone (EZ), enterprise community or renewal community.

Work Opportunity Tax Credit Statistics for Ohio

In 2019 the state of Ohio issued 97,918 Work Opportunity Tax Credit certifications. Nationwide Ohio issued 4.73% of WOTC Tax Credits in 2019. Ohio was in the top five of states that issuing WOTC certifications. SNAP recipients was Ohio’s highest category of certifications at 68.6%.

WOTC Questions: I Only Hire Seasonally, Can I Still Use WOTC? Can I Hire Previous Employees?

CMS Says: Yes, you can hire NEW seasonal employees, and still take advantage of the Work Opportunity Tax Credit. However, if you are rehiring prior employees on a seasonal basis, they would not be eligible. The WOTC is only available to new employees, not rehires.

Switch to Paperless WOTC Screening Today

CMS has been providing Work Opportunity Tax Credit screening services for over 20 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

-

- Your WOTC Dashboard

- How to Check if You are in an Empowerment Zone, Enterprise Zone, or Rural Renewal County

- Work Opportunity Tax Credit By The Numbers 2019

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- Tips to Maximize WOTC Participation and Increase Savings in 2020

- WOTC’s 28-Day Rule Explained

- WOTC’s Target Groups

- Calculate your WOTC Savings

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive