CMS Work Opportunity Tax Credit Newsletter February 2022

In this issue:

- WOTC In The News Roundup

- New Spanish Language Option Available Online

- WOTC Wednesday: On What Tax Form is the WOTC Tax Credit Taken?

- Understanding WOTC’s Target Groups: Qualified IV-A Recipient

- Work Opportunity Tax Credit Statistics for Idaho

- Switch To Paperless WOTC Screening

- #ICYMI

WOTC In The News Roundup

This article provides a roundup of recent news stories related to the Work Opportunity Tax Credit.

New WOTC Spanish Language Option Available Online

There is a new Spanish language option available on the online Work Opportunity Tax Credit screening form. To switch to Spanish, applicants can simply click on the link at the top of the page “Haga clic aquí para traducir al espñol” (“Click here to translate to Spanish”). This will allow them to complete the screening completely in Spanish. As we all know, there is a higher success rate when applicants can easily understand the questions being asked.

WOTC Wednesday: On What Tax Form is the WOTC Tax Credit Taken?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday.

Other Recent WOTC Questions Answered:

- WOTC Wednesday: When Is The Best Time To Give the Applicant the Work Opportunity Tax Credit Survey?

- WOTC Wednesday: How Far Back Can We Go With the Work Opportunity Tax Credit?

- WOTC Wednesday: Is it Worth it to Use the Work Opportunity Tax Credit?

Understanding WOTC’s Target Groups: Qualified IV-A Recipient

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #2 is the Qualified IV-A Recipient, better known as TANF (Temporary Assistance to Needy Families). 56,526 individuals were hired with certification from this group in 2021, 2.72% of the total, making it the seventh overall certified category.

A “Qualified IV-A Recipient” is an individual who on the date of hire is:

An individual who is a member of a family receiving assistance under a state plan approved under part A of title IV of the Social Security Act relating to Temporary Assistance for Needy Families (TANF). The assistance must be received for any 9-month period during the 18-month period ending on the hiring date.

The maximum tax credit available for hiring a Qualified IV-A Recipient is $2,400.

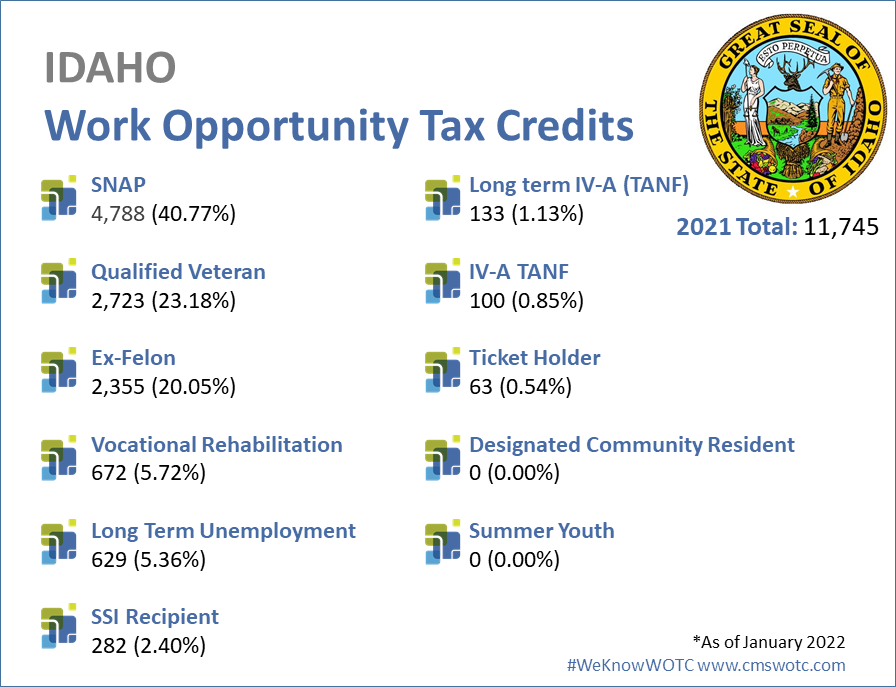

Work Opportunity Tax Credit Statistics for Idaho

In 2021 the state of Idaho issued 11,745 Work Opportunity Tax Credit certifications. Idaho issued 0.56% of all WOTC Tax Credits in 2021, SNAP was Idaho’s highest tax credit category with 40.77% of certifications for that category.

Switch to Paperless WOTC Screening

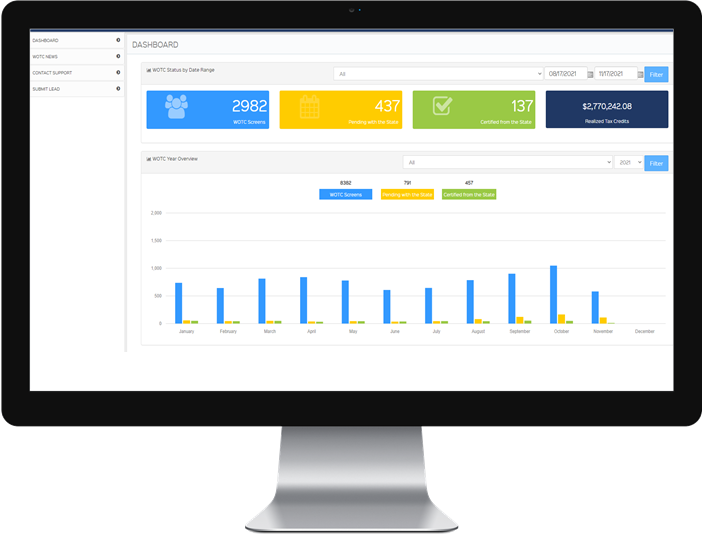

CMS has been providing Work Opportunity Tax Credit screening services for 25 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

-

- Your WOTC Dashboard

- Increased Integration for WOTC Tax Credit to iRecruit, Applicant Tracking Software

- Work Opportunity Tax Credit By The Numbers 2020

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- Important Notice: URL Changes for Online WOTC Forms

- Four Things You Didn’t Know About the Work Opportunity Tax Credit

- WOTC’s Target Groups

- Calculate your WOTC Savings

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive