CMS Work Opportunity Tax Credit Newsletter November 2020

In this issue:

- Keeping an Eye on Washington for a Work Opportunity Tax Credit Renewal

- Cost Management Services Achieves Veracode Verified Standard Status

- Webinar Alert: Shoring Up Recruitment Strategy During and Beyond COVID-19

- Understanding WOTC’s Target Groups: Long Term Family Assistance

- Work Opportunity Tax Credit Statistics for North Carolina

- WOTC Questions: Can I still get credit if my employee only worked two weeks?

- Switch To Paperless WOTC Screening

- #ICYMI

Keeping an Eye on Washington for a Work Opportunity Tax Credit Renewal

The Work Opportunity Tax Credit (WOTC) is currently scheduled to expire on 12/31/2020. CMS is keeping a keen eye out for any news on renewal for WOTC. As of 12/3 renewal is still pending. We will alert you as soon as there is an update.

Cost Management Services Achieves Veracode Verified Standard Status

CMS is committed to delivering secure code to help organizations reduce the risk of a security breach. Companies that invest in secure coding processes and follow our protocol for a mature application security program are able to deliver more confidence to customers who deploy their software,” said Asha May, Director of Customer Engagement, Veracode.

Webinar Alert: Shoring Up Recruitment Strategy During and Beyond COVID-19

As employers in the era of COVID-19 and social distancing, you may have to quickly pivot your recruiting and even your messaging to candidates. What are the best practices for success? We invite you to join Christina Broussard from Indeed’s Employer Insights team for an informative look at recruiting and hiring in today’s fast-changing landscape on January 21st at 1pm.

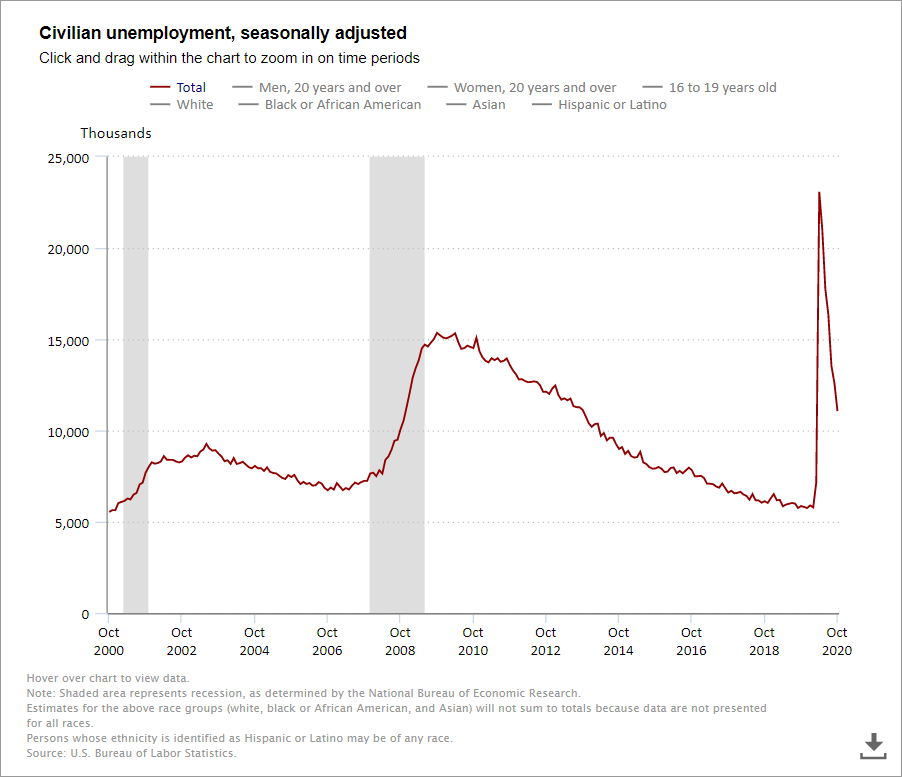

Understanding WOTC’s Target Groups: Long-term Unemployment Recipient

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #10 is the Long-term Unemployment Recipient. A qualified long-term unemployment recipient is one who has been unemployed for not less than 27 consecutive weeks at the time of hiring and received unemployment compensation during some or all or the unemployment period. The most recent BLS unemployment numbers (PDF) put the current rate at 6.9%, unemployment is still very high, which makes this a category to watch. California issued the most certificates for this target group in 2019. Long-Term Unemployment Recipient accounted for 4.67% of all credits in 2019, and was the third most used credit.

Work Opportunity Tax Credit Statistics for North Carolina

In 2019 the state of North Carolina issued 80,055 Work Opportunity Tax Credit certifications. Nationwide the state issued 3.87% of all WOTC Tax Credits in 2019. SNAP recipients were North Carolina’s largest category at 82.51%.

WOTC Questions: Can I still get credit if my employee only worked two weeks?

CMS Says: Unless they worked 120 hours over two weeks, unfortunately not. Even if the employee was eligible and you received certification, the value of the Work Opportunity Tax Credit is determined by how many hours the employee worked. For example, if someone worked 120 hours at $15 per hour, for a total of $1,800 in wages, because they reached 120 hours you would be eligible for a $450 tax credit for that person.

Other Recent WOTC Questions Answered:

- If I have ex-felons making me eligible for wotc credit where do I report?

- Once an employee hits the 400 hours mark can an employer continue to earn tax credits on them or have they hit the max?

- What Sets the Company Apart From its Competitors?

Switch to Paperless WOTC Screening

CMS has been providing Work Opportunity Tax Credit screening services for over 20 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

- Your WOTC Dashboard

- Senator Rob Portman (R-OH) Calls to Make Work Opportunity Tax Credit Permanent

- Increased Integration for WOTC Tax Credit to iRecruit, Applicant Tracking Software

- Work Opportunity Tax Credit By The Numbers 2019

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- Tips to Maximize WOTC Participation and Increase Savings in 2020

- WOTC’s 28-Day Rule Explained

- WOTC’s Target Groups

- Calculate your WOTC Savings

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive