With 25+ years of experience in Work Opportunity Tax Credit screening and processing, we would like to offer you some tips to make sure you get the maximum tax credit available. On average the United States spends $5 Billion each year on this program. How much did you get?

The Work Opportunity Tax Credit program was recently renewed for five years.

- Make sure to include the WOTC forms (8850 and 9061) as part of your onboarding process to make it easy for new hires. Give the new hires the “paperwork” along with their W-4 and I-9 and any other documents you use during onboarding or preboarding.

- Give WOTC Forms to ALL new employees, not just employees you “think” may qualify, to avoid any potential discrimination issues.

- Explain what “WOTC” is if the new hires ask questions. Most new hires will not be familiar with the program at all. Remember it’s voluntary on behalf of the employee, so ask politely for their participation, and let them know why they are given the forms.

- Using Paper Forms? Use this checklist to make sure forms are completed correctly:

- Did your employee sign and date the WOTC forms correctly?

- Is the paperwork legible?

- Is the required information complete?

- Did you put in their start date?

- Did you put in their job title and hourly wage?

- Has the employee worked for your company before? (Important, WOTC is only available for new hires).

- Is the paperwork complete within 28 days of the employee’s start date?

- Submit your WOTC paperwork on time! You can do this online with CMS or in the mail within 28 days of the employee’s start date to the State Workforce Agency. CMS helps keep you in compliance with this rule with our online portal and reports.

- Cut down on language barriers, and get more tax credits, by using translation tools which we offer through our online form or call center. Our online form can translate over 100 languages. The more likely the applicant understands the question, the higher the response rate will be.

- Hiring Veterans? Request a copy of their DD214 as part of the onboarding process. This will save time if the State Workforce Agency needs to request a copy from you.

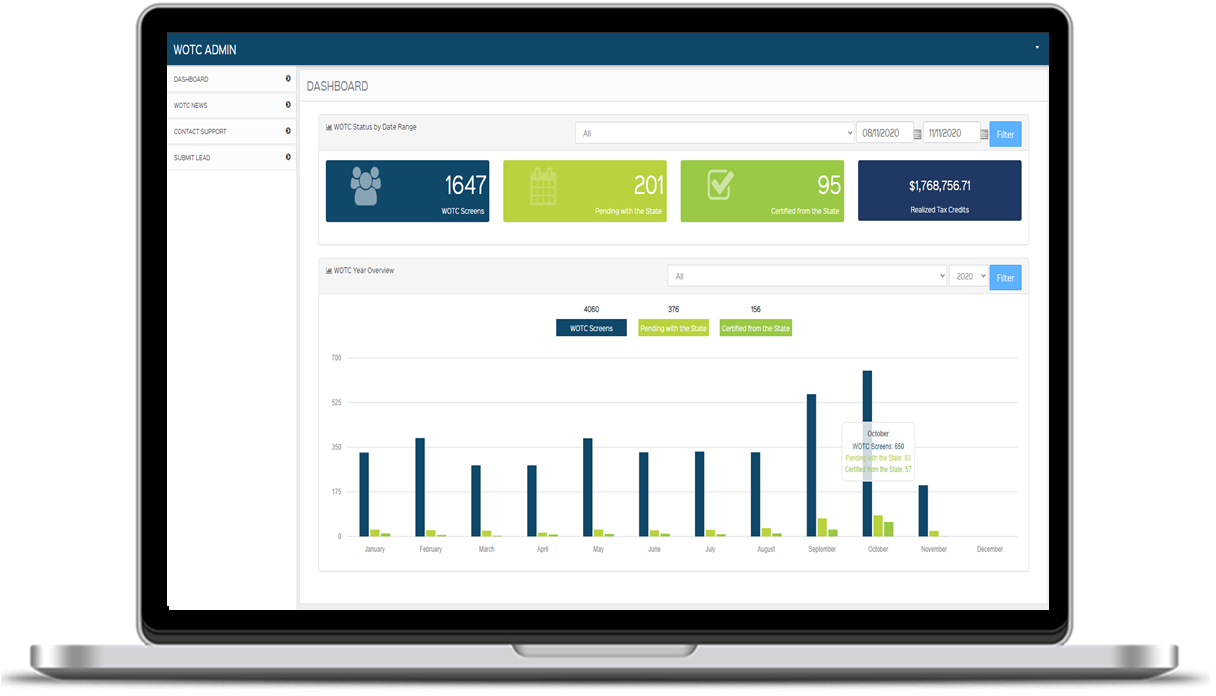

- Track progress using CMS’s online portal, where you can see, in real-time, that your new hires are completing their forms so you don’t miss anyone. Again, WOTC is voluntary, but all employees should be encouraged to participate.

- Use a WOTC Administration service like CMS. We screen all your new hires to find you tax credits. On average 10-15% of your new hires may qualify which can lead to significant savings.

- Track Hours and Wages. Track the employee’s hours and wages in your payroll program, or on a spreadsheet. The actual value of your credits is based on this information. Employees must work a minimum of 120 hours to be eligible.

- Cut down on paperwork and save time! CMS offers several easy ways to submit your WOTC forms:

- Secure Online application (with translation).

- 1-800 Call Center (with translation).

- Secure Fax.

- Mail.

*Example WOTC Dashboard.

How much can you save?

On average 10-15% of your new hires may be qualified for up to $2,400-$9,600 worth of tax savings under the WOTC program guidelines. This varies by region and category. WOTC Calculator.

WOTC is easy to set up and easy to use.

We recommend including WOTC screening as part of your onboarding process. WOTC screening can be done via phone, secure web portal, or mail/fax. We do all the rest. We screen new hires for eligibility and submit qualified new hires to the appropriate state agency. When we receive credit, we track the hours worked and wages received to ensure you get the maximum credit available.

- Why you should use CMS’s WOTC Tax Screening Service rather than doing it yourself.

- Get an idea of how much you could be saving by utilizing the Work Opportunity Tax Credit for your company, try our WOTC Calculator.

- Are you a CPA or tax service provider? Find out how you can become a strategic Business Partner.

Contact CMS Today to Start Saving!

In over 20 years of providing valuable WOTC Screening and Administration services we’ve saved millions for our customers.

Contact CMS today to start taking advantage. Call 800-517-9099, or click here to use our contact form to ask any questions.