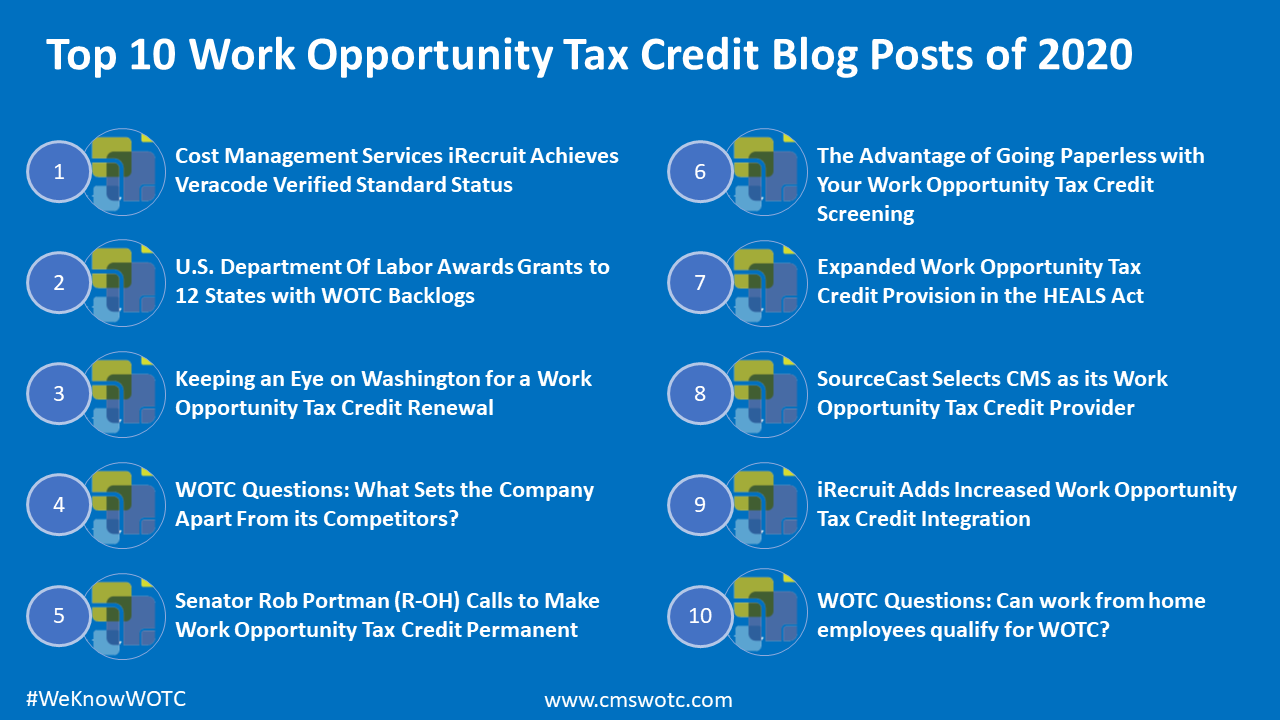

Cost Management Services iRecruit Achieves Veracode Verified Standard Status

Security has always been a high priority for CMS,” said CMS’s Managing Partner, Brian Kelly, “With both our iRecruit application, and Work Opportunity Tax Credit processing, we need to provide a secure software for our customers.

U.S. Department Of Labor Awards Grants to 12 States with WOTC Backlogs

The grants will help state workforce agencies streamline their business processes and systems to reduce the processing backlog, including the number of accumulated certification requests that employers have submitted and await processing.

Keeping an Eye on Washington for a Work Opportunity Tax Credit Renewal

One of the aspects in favor of the Work Opportunity Tax Credit is that it has always had bipartisan support to aid in its renewal. There are currently 28 Bills in the House of Representatives, and six in the Senate that reference WOTC.

WOTC Questions: What Sets the Company Apart From its Competitors?

We love this question! Our customers choose CMS over the competition for several reasons. We do not charge anything unless we find you tax credits (win-win). Unlike larger companies we provide a single-point-of-contact for your staff to work with. So if you have a question, you’ll know who to call.

Senator Rob Portman (R-OH) Calls to Make Work Opportunity Tax Credit Permanent

The Ohio Senator called for an expansion of the Work Opportunity Tax Credit and for making it permanent, and to update the qualifying categories due to Covid-19.

The Advantage of Going Paperless with Your Work Opportunity Tax Credit Screening

It’s much faster. Going paperless is super efficient. Less printing, less mailing, less making sure your hiring managers are compliant.

Expanded Work Opportunity Tax Credit Provision in the HEALS Act

The HEALS Act would temporarily expand the Work Opportunity Tax Credit (WOTC) to employers hiring individuals in qualified groups, and would include a new targeted group defined as 2020 qualified COVID-19 unemployment recipients.

SourceCast Selects CMS as its Work Opportunity Tax Credit Provider

Across the country, HR professionals recognize the need to accelerate their hiring practices. This agreement brings together two influential service providers to help businesses work efficiently.

iRecruit Adds Increased Work Opportunity Tax Credit Integration

The new streamlined integration allows customers to increase their WOTC participation, quickly identify potentially qualified candidates through reporting and dashboard widgets, as well as the applicant profile page.

WOTC Questions: Can work from home employees qualify for WOTC?

Yes work from home employees are eligible to participate in the Work Opportunity Tax Credit program. There are no restrictions as to where an employee must work. So it they could work in your office, building, outdoors or at home.

About Our WOTC Screening Services

- Why you should use CMS’s WOTC Tax Screening Service rather than doing it yourself.

- Get an idea of how much you could be saving by utilizing the Work Opportunity Tax Credit for your company, try our WOTC Calculator.

- Are you a CPA or tax service provider? Find out how you can become a strategic Business Partner.

Contact CMS Today to Start Saving!

In over 20 years of providing valuable WOTC Screening and Administration services we’ve saved millions for our customers.

Contact CMS today to start taking advantage. Call 800-517-9099, or click here to use our contact form to ask any questions.