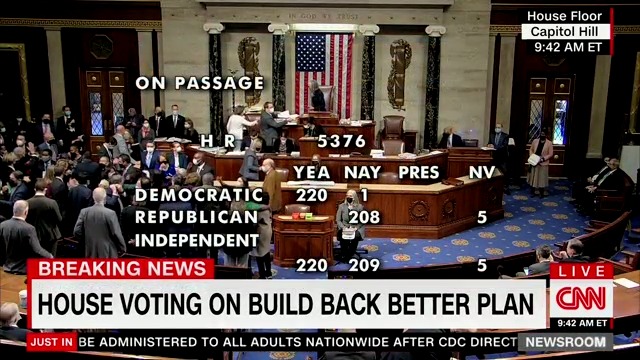

Huge news, the Build Back Better Act has passed in the House this morning with a vote of 220-209. It now heads to the Senate. Build Back Better includes provisions for the Work Opportunity Tax Credit that would increase the credit amount from $2,400 to $5,000 per qualified individual. In addition, it would allow for rehires to qualify for WOTC during the COVID-19 recovery period through the end of 2022. Read more: Significant Increase to the Work Opportunity Tax Credit Proposed.

CMS will be watching this closely, and will alert our customers and partners of any updates as they occur.

Read more: House Narrowly Passes Biden’s Social Safety Net and Climate Bill (New York Times)