Once an employee hits the 400 hours mark can an employer continue to earn tax credits on them or have they hit their max?

At CMS, as Work Opportunity Tax Credit (WOTC) experts and service providers since 1997, we receive a lot of questions via our website. In the case of the above question, the sender did not provide their email address, so we were unable to reply directly to them. This is one of the more common questions (FAQ), so we thought we would share, and hopefully will help others too.

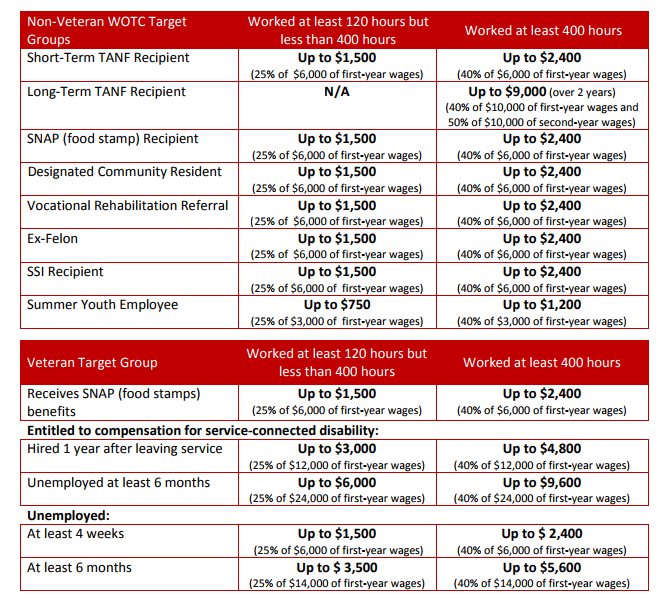

CMS Says: Great question. This will actually depend on the wages the employee receives. Once an employee hits the 400 hour mark, have they received $6,000 in wages? If you answer yes to this question, then the answer is yes. If you answer no, to the question, the employee can continue to work until $6,000 of wages is reached. When $6,000 in wages or salary is reached you will have received the maximum tax credit of $2,400 – 40% of that $6,000. You can use this chart to calculate hours and wages of the different target groups:

Contact CMS Today to Start Saving!

In our 21+ years of performing WOTC Screening and Administration we’ve saved millions for our customers.

Contact CMS today to start taking advantage. Call 800-517-9099, or click here to use our contact form.