CMS WOTC Newsletter January 2020

In this issue:

- Work Opportunity Tax Credit Renewed Through 2020

- Tips to Maximize WOTC Participation and Increase Savings in 2020

- How to Check if You are in an Empowerment Zone, Enterprise Zone, or Rural Renewal County

- Your New WOTC Dashboard

- Seven Reasons to Use Paperless WOTC Screening Today

- WOTC Questions: Your Most Frequently Asked Questions Slideshow

- Your WOTC Screening Options

- #ICYMI

Work Opportunity Tax Credit Renewed Through 2020

![US_Capitol_Building_Front-e1461860385263[1]](http://www.irecruit-software.com/wp-content/uploads/2020/01/US_Capitol_Building_Front-e14618603852631-1024x584.jpg)

As a leading provider of Work Opportunity Tax Credit (WOTC) administration services, Cost Management Services (CMS) had been diligently watching the renewal status of the Work Opportunity Tax Credit all year long and were thrilled to hear it was renewed. The legislation includes renewing and extending to December 31, 2020:

- Indian Employment Credit (IEC) from 2017

- Federal Empowerment Zones (FEZ) from 2017

- Work Opportunity Tax Credit, (Renewed through 12/31/2020)

CMS’s Brian Kelly said of the renewal: “We are extremely pleased with the news that the Work Opportunity Tax Credit has been renewed and extended through the end of 2020. We have customers from all across the United States anticipating tax credits, and due to its extension they will be pleased to know that there is no hiatus for the program.”

Tips to Maximize WOTC Participation and Increase Savings in 2020

We’re pleased that the WOTC program will continue to be active throughout 2020 without any hiatus or downtime. Every year we update our list of tips you can use to make sure you’re making the most of the WOTC Tax Credit.

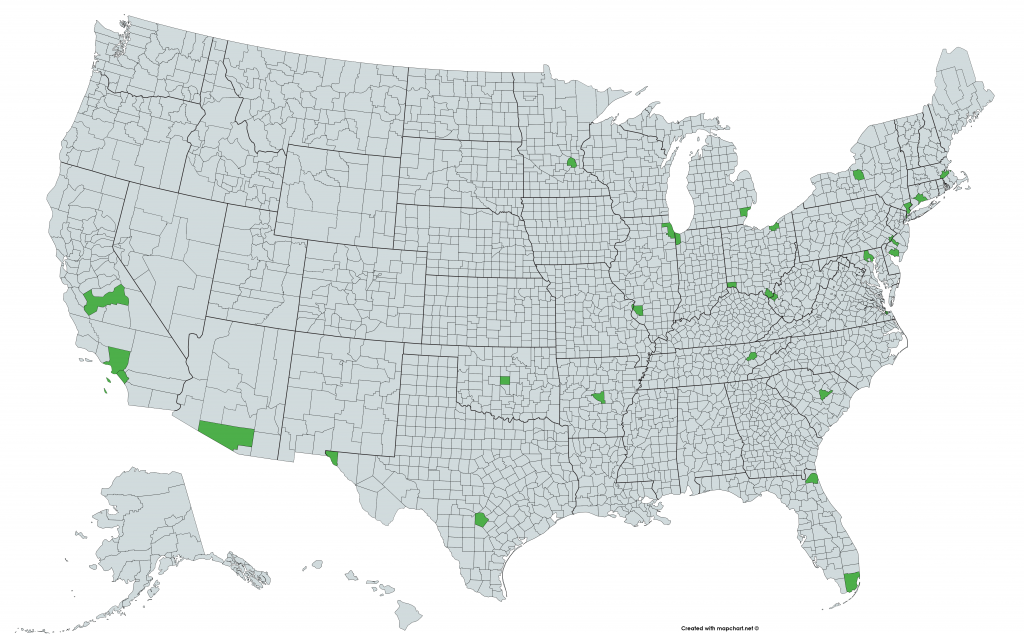

How to Check if You are in an Empowerment Zone, Enterprise Zone, or Rural Renewal County

CMS has a helpful map of the United States Empowerment Zones, Enterprise Zones, or Rural Renewal Counties. Use your mouse to zoom in or out to see your location(s). As stated above, the Federal Empowerment Zones have been renewed through the end of 2020.

Your New WOTC Dashboard

We have a new look to your Work Opportunity Tax Credits dashboard. The new look provides a more functional and mobile friendly layout. Customers can use the WOTC Portal Dashboard to monitor the status of their tax credits, see how many has been received, how many are certified, denied or still pending, and make sure that all new hires are complying.

Seven Reasons to Use Paperless WOTC Screening Today!

CMS has been providing Work Opportunity Tax Credit screening services for over 20 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We currently offer three ways you can screen your employees: paper, call center and online. We highly encourage customers to take advantage of the online form that we developed or the call center, both of which provide several benefits to you.

WOTC Questions: Your Most Frequently Asked Questions Slideshow

Every Wednesday #WOTCWednesday we answer questions we receive on our website, so we put together The Work Opportunity Tax Credit’s Most Frequently Asked Questions Slideshow with the questions we receive most often.

Your WOTC Screening Options

CMS provides three easy screening options for the Work Opportunity Tax Credit: Paper, Online, or by Phone. We recommend screening ALL new employees to avoid any potential discrimination.Contact your expert WOTC team via email or at 800-517-9099 if you have any questions.

#ICYMI

- Introduction to the Work Opportunity Tax Credit

- Work Opportunity Tax Credit Statistics for 2018

- Work Opportunity Tax Credit Checklist

- WOTC’s 28-Day Rule Explained

- WOTC’s Target Groups

- Calculate your WOTC Savings

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive