CMS Work Opportunity Tax Credit Newsletter January 2021

In this issue:

- Work Opportunity Tax Credit Renewed for FIVE Years!

- Important Notice: URL Changes for Online WOTC Forms

- WOTC Wednesday: Which State Issues the Most Amount of WOTC Tax Credits?

- Upcoming Webinar: Shoring Up Recruitment Strategy During and Beyond COVID-19

- Top 10 Work Opportunity Tax Credit Blog Posts of 2020

- Understanding WOTC’s Target Groups: Qualified IV-A Recipient

- Work Opportunity Tax Credit Statistics for North Carolina

- Switch To Paperless WOTC Screening in 2021

- #ICYMI

Work Opportunity Tax Credit Renewed for FIVE Years!

With the Covid-19 Relief Bill that passed and was signed into law on December 27th, the Work Opportunity Tax Credit has been extended through December 31, 2025. This is great news for our WOTC customers because they will not have to deal with any hiatus or wait for a renewal. As always we will keep you apprised of any changes or additional updates.

Important Notice: URL Changes for Online WOTC Forms

On Sunday, January 17, 2021 CMS will be updating the URLs for completing the WOTC survey online and accessing your Administration portal. The domains will automatically forward to their new address, so there will be no interruption in service. It will be helpful to update any saved links or bookmarks you have when this change takes place. We will send out reminder emails before and after the change.

WOTC Wednesday: Which State Issues the Most Amount of WOTC Tax Credits?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our new weekly video Q&A series #WOTCWednesday.

Other Recent WOTC Questions Answered:

- Can WOTC credit be taken for an employee without a prior certification?

- What are the carry back and carry forward rules for using the WOTC tax credit?

- I want to print out the 8850 and 9061, where do I find it?

Upcoming Webinar: Shoring Up Recruitment Strategy During and Beyond COVID-19

As employers in the era of COVID-19 and social distancing, you may have to quickly pivot your recruiting and even your messaging to candidates. What are the best practices for success? Join iRecruit and Christina Broussard from Indeed.com’s Employer Insights team for an informative look at recruiting and hiring in today’s fast-changing landscape.

Date: Thursday, January 21st, 2021

Time: 1:00pm Eastern/10:00am Pacific

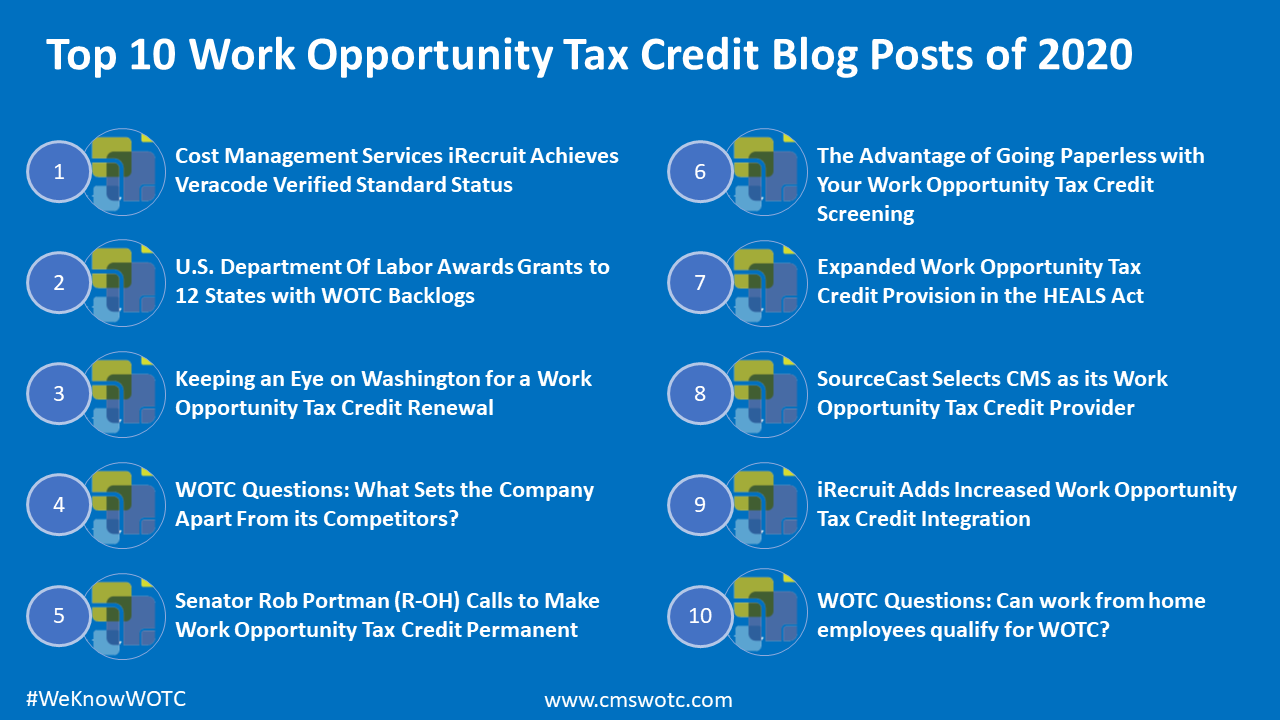

Top 10 Work Opportunity Tax Credit Blog Posts of 2020

A look back at our website’s most popular blog posts of 2020. #WeKnowWOTC

Understanding WOTC’s Target Groups: Qualified IV-A Recipient

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #1 is the Qualified IV-A Recipient. An Qualified IV-A Recipient is an individual who is a member of a family receiving assistance under a state plan approved under part A of title IV of the Social Security Act relating to Temporary Assistance for Needy Families (TANF). The assistance must be received for any 9-month period during the 18-month period ending on the hiring date. California issues the most tax credit certifications for this target group.

Work Opportunity Tax Credit Statistics for North Carolina

In 2019 the state of North Carolina issued 80,055 Work Opportunity Tax Credit certifications. Nationwide the Tar Heel state issued 5.91% of all WOTC Tax Credits in 2019. SNAP was North Carolina’s highest tax credit category with 82.5% of certifications for that category.

Switch to Paperless WOTC Screening in 2021

CMS has been providing Work Opportunity Tax Credit screening services for over 20 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

-

- Your WOTC Dashboard

- Increased Integration for WOTC Tax Credit to iRecruit, Applicant Tracking Software

- Work Opportunity Tax Credit By The Numbers 2019

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- Tips to Maximize WOTC Participation and Increase Savings in 2020

- WOTC’s 28-Day Rule Explained

- WOTC’s Target Groups

- Calculate your WOTC Savings

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive