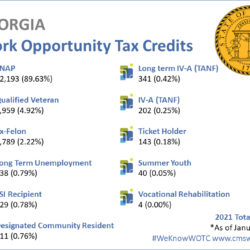

Work Opportunity Tax Credit Statistics Georgia 2023

In 2023 the state of Georgia issued 65,424 Work Opportunity Tax Credit certifications. The Work Opportunity Tax Credit, known as WOTC, is a federal tax credit available to employers who hire individuals from target groups, that include qualified Veterans, individuals on food stamps and more. The Work Opportunity Tax Credit is available throughout the United States, and[…]