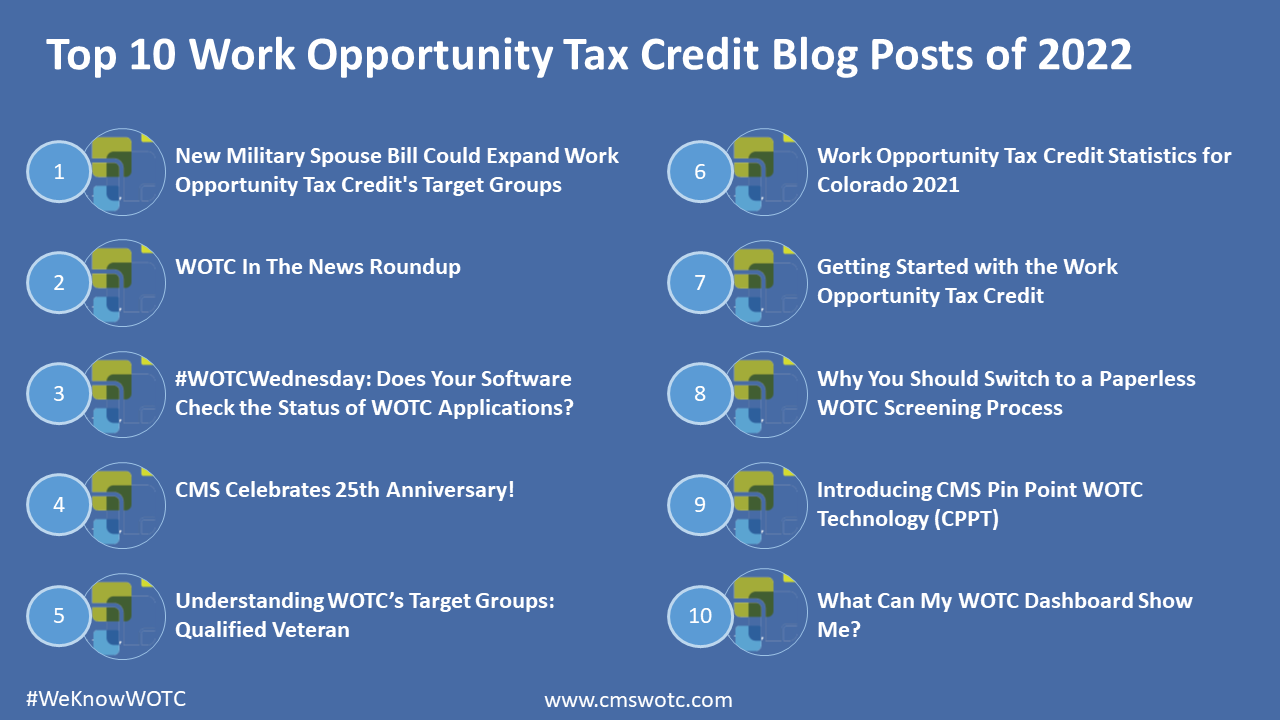

Happy New Year! At this time of year we like to take a look back at some of our most popular blog posts of the year. So here is this year’s list of the top CMS WOTC blog posts of 2022!

New Military Spouse Bill Could Expand Work Opportunity Tax Credit’s Target Groups

A bipartisan group introducing a bill to add Military Spouses to the Work Opportunity Tax Credit target groups. The “Military Spouse Hiring Act” to make employers of military spouses eligible for the work opportunity credit, was introduced to the Senate Finance in March.

WOTC In The News Roundup

Fox 26 News reports that California’s EDD has backlog of 400,000 applications for grant money meant to help businesses, workers. California was one of 12 states that received a Department of Labor grant in 2020 to address the WOTC backlog.

#WOTCWednesday: Does Your Software Check the Status of WOTC Applications?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly series.

CMS Celebrates 25th Anniversary!

CMS is celebrating 25 years in business! back in 1997 Brian Kelly started “CMS” in the HR software and tax credit business, supporting businesses across the New England area. We developed our own software for both tax credits (WOTC) and iRecruit, Applicant Tracking and Remote Hiring Software. Congratulations Brian!

Understanding WOTC’s Target Groups: Qualified Veteran

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #2 is the Qualified Veteran. 101,806 individuals were hired with certification from this group in 2021, 4.89% of the total, making it the third overall certified category.

Work Opportunity Tax Credit Statistics for Colorado 2021

In 2021 the state of Colorado issued 33,866 Work Opportunity Tax Credit certifications. Colorado issued 1.63% of all WOTC Tax Credits in 2021, SNAP was Colorado’s highest tax credit category with 50.19% of certifications for that category. See historical data on Colorado and the Work Opportunity Tax Credit.

Getting Started with the Work Opportunity Tax Credit (Video)

CMS’s full Video series about how you can get started using the Work Opportunity Tax Credit.

Why You Should Switch to a Paperless WOTC Screening Process

CMS’s online web link screening system screens your WOTC new hires with ease. The benefits of using the online screening system include:

Introducing CMS Pin Point WOTC Technology (CPPT)

CMS’s Pin Point WOTC Technology (CPPT) performs a multi-step process to detect, identify and confirm new hires living in Federal Empowerment Zones and Rural Renewal Communities. CMS provides another technology tool designed to maximize the federal tax credit program for our clients.

What Can My WOTC Dashboard Show Me?

Your Work Opportunity Tax Credit (WOTC) Dashboard gives you a real-time overview of the activity in your account. The Dashboard contains the following features.

About Our WOTC Screening Services

- Why you should use CMS’s WOTC Tax Screening Service rather than doing it yourself.

- Get an idea of how much you could be saving by utilizing the Work Opportunity Tax Credit for your company, try our WOTC Calculator.

- Are you a CPA or tax service provider? Find out how you can become a strategic Business Partner.

Contact CMS Today to Start Saving!

In 25 years of providing valuable WOTC Screening and Administration services we’ve saved millions for our customers.

Contact CMS today to start taking advantage. Call 800-517-9099, or click here to use our contact form to ask any questions.