In 2023 the state of Hawaii issued 325 Work Opportunity Tax Credit certifications.

The Work Opportunity Tax Credit, known as WOTC, is a federal tax credit available to employers who hire individuals from target groups, that include qualified Veterans, individuals on food stamps and more.

The Work Opportunity Tax Credit is available throughout the United States, and in 2023 it was worth approximately $4.7 Billion dollars to employers. 1,982,858 total Work Opportunity Tax Credits were issued in the United States in 2023. WOTC was renewed for five years, and is currently active through 12/31/2025.

Nationwide, Hawaii issued 0.02% of WOTC Tax Credits in 2023.

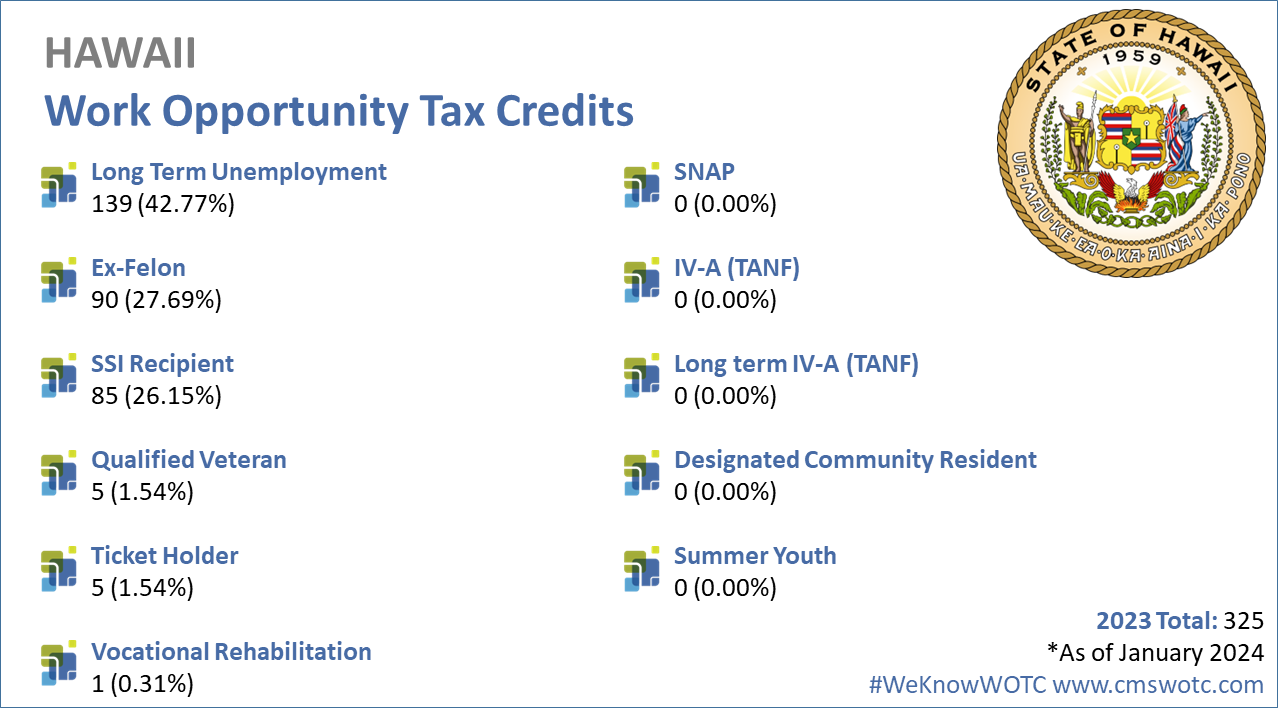

Work Opportunity Tax Credit Statistics for Hawaii 2023:

In 2023 the state of Hawaii issued 325 Work Opportunity Tax Credit certifications, or 0.02% overall. Long-Term Unemployment was Hawaii’s highest target group with 42.77% of credits.

More about the Work Opportunity Tax Credit’s target groups.

Hawaii WOTC Tax Credit Certification 2014 – 2023:

| WOTC Certifications | Current Pending* | Denials | Total Requests | |

| 2023 | 325 | 41,397 | 299 | 42,021 |

| 2022 | 1,902 | 30,315 | 3,606 | 35,823 |

| 2021 | 2,938 | 27,201 | 4,272 | 34,411 |

| 2020 | 1,896 | 28,557 | 1,617 | 32,070 |

| 2019 | 750 | 12,425 | 1,454 | 14,629 |

| 2018 | 815 | 12,808 | 4,522 | 18,145 |

| 2017 | 2,276 | 7,892 | 2,245 | 12,413 |

| 2016 | 3,735 | 3,140 | 3,457 | 10,332 |

| 2015 | 3,494 | 3,819 | 3,412 | 10,725 |

| 2014 | 1,883 | 1,460 | 2,382 | 5,725 |

*Pending at time of publishing (February 2024).

About Our WOTC Screening Services

- Why you should use CMS’s WOTC Tax Screening Service rather than doing it yourself.

- Get an idea of how much you could be saving by utilizing the Work Opportunity Tax Credit for your company, try our WOTC Calculator.

- Are you a CPA or tax service provider? Find out how you can become a strategic Business Partner.

Contact Us for More Information or To Get Started Today

In over 25 years of performing WOTC Screening and Administration we’ve saved millions for our customers.

Contact CMS today to start taking advantage. Call 800-517-9099, or click here to use our contact form to ask any questions.