CMS Work Opportunity Tax Credit Newsletter April 2024

In this issue:

- Expiring POA Forms

- CMS WOTC Screening Services

- CMS Pin Point WOTC Technology (CPPT)

- WOTC Wednesday: Are rehires eligible for the Work Opportunity Tax Credit?

- Understanding the Work Opportunity Tax Credit’s Target Groups: Summer Youth Employee

- Work Opportunity Tax Credit Statistics for Florida 2023

- #ICYMI

Expiring POA Forms

If your Power of Attorney (POA) document for the Work Opportunity Tax Credit is expiring soon please keep screening. Don’t miss out on tax credits! Lisa and Sean will be reaching out to you to renew over the next few weeks with a new one. If you have any questions or concerns, please contact us at 800-517-9099.

CMS WOTC Screening Services

Share this video with your colleagues, or anyone who needs to get up-to-speed on the Work Opportunity Tax Credit.

CMS Pin Point WOTC Technology (CPPT)

CMS’s Pin Point WOTC Technology (CPPT) performs a multi-step process to detect, identify and confirm new hires living in Federal Empowerment Zones and Rural Renewal Communities. CMS provides another technology tool designed to maximize the federal tax credit program for our clients.

WOTC Wednesday: Are rehires eligible for the Work Opportunity Tax Credit?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday. Follow us on our new TikTok.

Other Recent #WOTCWednesday Questions Answered:

- Is there a limit to how many WOTC credits I can claim each year?

- What is the Work Opportunity Tax Credit amount for hiring an Ex Felon?

- Is it Worth it for Employers to Use the Work Opportunity Tax Credit?

Submit your question for Brian here.

Understanding the Work Opportunity Tax Credit’s Target Groups: Summer Youth Employee

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #7 is the Summer Youth Employee. 1,209 individuals were hired with certification from this group in 2023, 1.2% of the total.

A “qualified summer youth employee” is one who:

- Is at least 16 years old, but under 18 on the hiring date or on May 1, whichever is later

- Only performs services for the employer between May 1 and September 15 (was not employed prior to May 1) and

- Resides in an Empowerment Zone (EZ)

The maximum tax credit available for hiring a qualified Summer Youth Employee is $1,200.

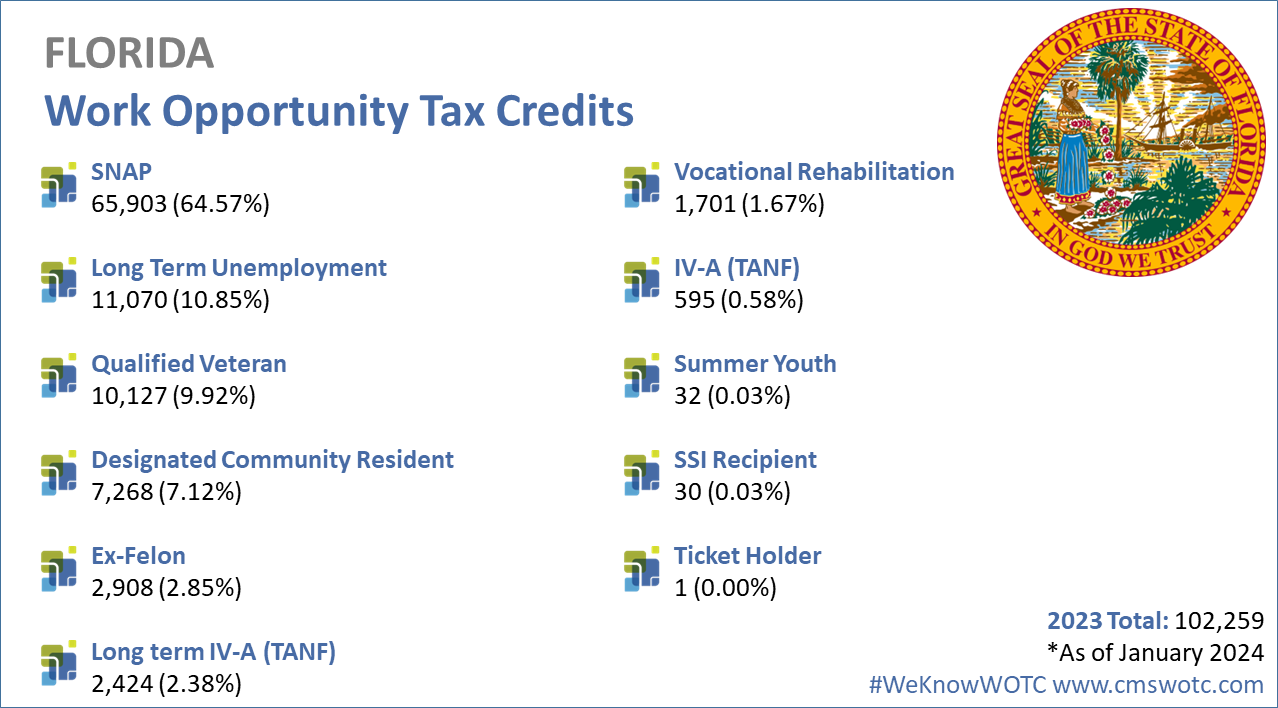

Work Opportunity Tax Credit Statistics for Florida 2023

In 2023 the state of Florida issued 102,059 Work Opportunity Tax Credit certifications. Florida issued 5.15% of all WOTC Tax Credits in 2023, SNAP Recipient was Florida’s highest tax credit target group with 64.57% of certifications for that category. See historical data on Florida and the Work Opportunity Tax Credit.

#ICYMI

-

- Your WOTC Dashboard

- New Spanish Language Option Available Online

- IRS Encourages Employers to Take Advantage of Work Opportunity Tax Credit

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- WOTC’s Target Groups

- Calculate your WOTC Savings

- Tips to Maximize WOTC Participation and Increase Savings

- The Work Opportunity Tax Credit (WOTC) Statistics 2022

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive