>

CMS Work Opportunity Tax Credit Newsletter August 2023

In this issue:

- How to Make WOTC a Part of Your Onboarding Process

- How to Check if You are in an Empowerment Zone, Enterprise Zone, or Rural Renewal County

- WOTC Wednesday: What is the Most Popular WOTC Target Group?

- Understanding the Work Opportunity Tax Credit’s Target Groups: Qualified Supplemental Security Income (SSI) Recipient

- Work Opportunity Tax Credit Statistics for Oklahoma

- #ICYMI

How to Make WOTC a Part of Your Onboarding Process

Adding WOTC to your onboarding process with new hires is simple. We offer 3 easy ways to include WOTC as part of your new hire “paperwork,” you can use one option, or a combination of all three, depending on your needs.

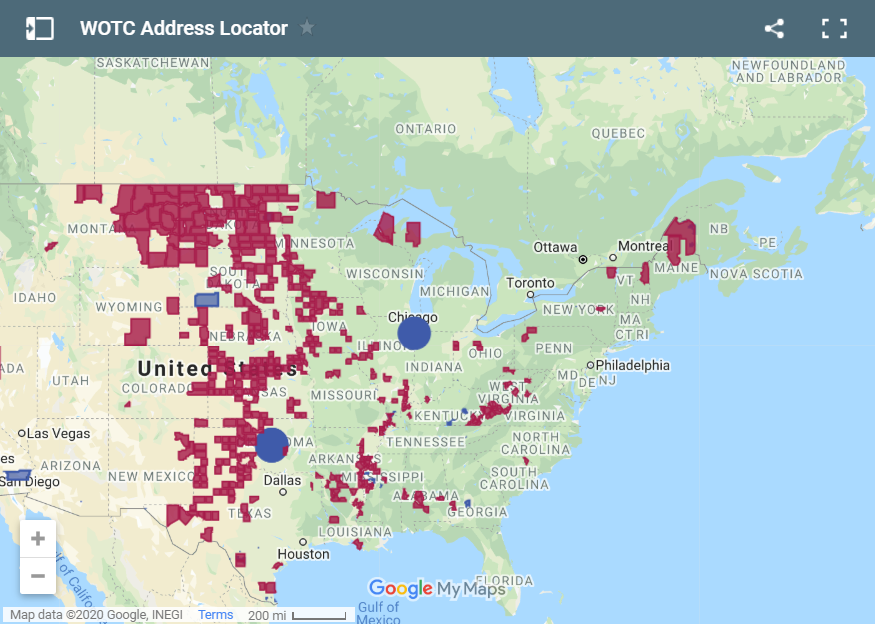

How to Check if You are in an Empowerment Zone, Enterprise Zone, or Rural Renewal County

If your new employees live in an Empowerment Zone, Enterprise Zone, or Rural Renewal Community (RRC) you may be eligible for a WOTC Tax Credit. Click on the map to zoom in and find out if your location qualifies.

WOTC Wednesday: What is the Most Popular WOTC Target Group?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday. Follow us on our new TikTok.

Other Recent #WOTCWednesday Questions Answered:

Submit your question for Brian here.

Understanding the Work Opportunity Tax Credit’s Target Groups: Qualified Supplemental Security Income (SSI) Recipient

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #8 is the Qualified Supplemental Security Income (SSI) Recipient. 59,467 individuals were hired with certification from this target group in 2022, 2.31% of the total.

- A “qualified SSI recipient” is an individual who received SSI benefits for any month ending within the 60-day period that ends on the hire date.

California hired the most qualified SSI recipients last year with 6,284 new hires qualifying under that target group. The maximum tax credit available for hiring a Supplemental Security Income (SSI) Recipient is $2,400.

In 2022 the state of Oklahoma issued 38,266 Work Opportunity Tax Credit certifications. Oklahoma issued 1.49% of WOTC Tax Credits in 2022. SNAP Recipient was Oklahoma’s highest tax credit target group with 52.44% of certifications for that category. See historical data on Oklahoma and the Work Opportunity Tax Credit.

#ICYMI

-

- Your WOTC Dashboard

- New Spanish Language Option Available Online

- IRS Encourages Employers to Take Advantage of Work Opportunity Tax Credit

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- WOTC’s Target Groups

- Calculate your WOTC Savings

- Tips to Maximize WOTC Participation and Increase Savings

- The Work Opportunity Tax Credit (WOTC) Statistics 2022

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive