CMS Work Opportunity Tax Credit Newsletter January 2024

Happy New Year from everyone at CMS!

Our goal for 2024 is to continue to provide you with the best possible service and to continue to improve on our support and services by listening to your feedback to see where we can do better.

– The CMS WOTC Team

In this issue:

- POA Forms Expiring at End of Last Year

- Top 10 Work Opportunity Tax Credit Blog Posts of 2023

- How to Make WOTC a Part of Your Onboarding Process

- IRS Encourages Employers to Take Advantage of Work Opportunity Tax Credit

- WOTC Wednesday: What is the Most Popular WOTC Target Group?

- Understanding WOTC’s Target Groups: Ex-Felon

- Work Opportunity Tax Credit Statistics for Illinois

- #ICYMI

POA Forms Expiring at End of Last Year

If your Power of Attorney (POA) document for the Work Opportunity Tax Credit is expired at the end of 2023, Please keep screening. Don’t miss out on tax credits! Lisa and Sean will be reaching out to you to renew over the next few weeks with a new one. If you have any questions or concerns, please contact us at 800-517-9099.

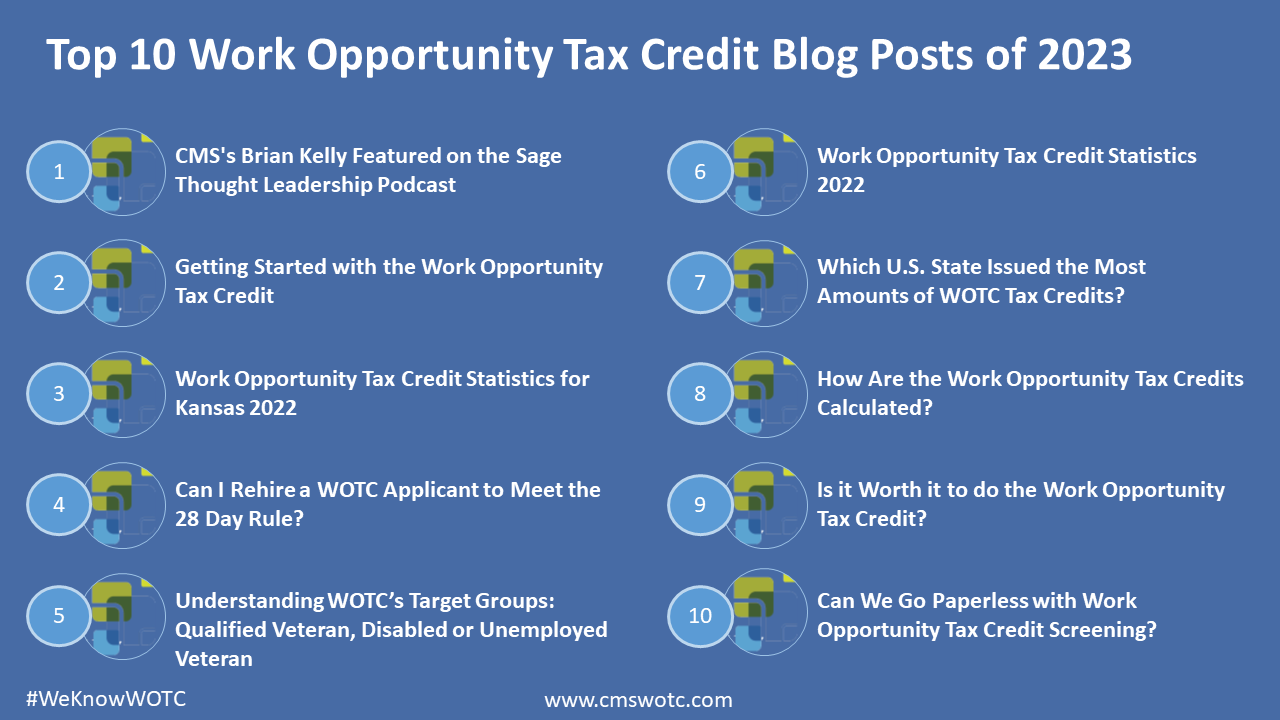

Top 10 Work Opportunity Tax Credit Blog Posts of 2023

A look back at some of our most popular blog posts of 2023!

How to Make WOTC a Part of Your Onboarding Process

Adding WOTC to your onboarding process with new hires is simple. We offer 3 easy ways to include WOTC as part of your new hire “paperwork,” you can use one option, or a combination of all three, depending on your needs.

IRS Encourages Employers to Take Advantage of Work Opportunity Tax Credit

The Internal Revenue Service reminds employers to check out a valuable tax credit available to them for hiring long-term unemployment recipients and other groups of workers facing significant barriers to employment.

WOTC Wednesday: What is the Most Popular WOTC Target Group?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday. Follow us on our new TikTok.

Other Recent #WOTCWednesday Questions Answered:

- How do I explain why we are asking new hires if they have received SNAP Benefits?

- Minimum number of hours an employee needs to work to be eligible for the Work Opportunity Tax Credit?

- Does WOTC Have a Limit to How Many WOTC Credits I Can Claim?

Submit your question for Brian here.

Understanding WOTC’s Target Groups: Ex-Felon

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #3 is the Ex-Felon. 73,809 individuals were hired with certification from this group in 2022, 2.87% of the total.

A “qualified ex-felon” is a person hired within a year of:

- Being convicted of a felony or

- Being released from prison for the felony

North Carolina hired the most Ex-Felons in 2022 with 7,681 new hires qualifying under that target group. The maximum tax credit for hiring a qualified Ex-Felon is $2,400.

Work Opportunity Tax Credit Statistics for Illinois

In 2022 the state of Illinois issued 136,729 Work Opportunity Tax Credit certifications. Illinois issued 5.32% of all WOTC Tax Credits in 2022, SNAP Recipient was Illinois’ highest tax credit target group with 71.96% of certifications for that category. See historical data on Illinois and the Work Opportunity Tax Credit.

#ICYMI

-

- Your WOTC Dashboard

- New Spanish Language Option Available Online

- IRS Encourages Employers to Take Advantage of Work Opportunity Tax Credit

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- WOTC’s Target Groups

- Calculate your WOTC Savings

- Tips to Maximize WOTC Participation and Increase Savings

- The Work Opportunity Tax Credit (WOTC) Statistics 2022

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive