>

CMS Work Opportunity Tax Credit Newsletter June 2023

In this issue:

- CMS’s Brian Kelly Featured on the Sage Thought Leadership Podcast

- IRS Encourages Employers to Take Advantage of Work Opportunity Tax Credit

- Why You Should Switch to a Paperless WOTC Screening Process

- WOTC Wednesday: What is a Conditional Certification for the Work Opportunity Tax Credit?

- Understanding the Work Opportunity Tax Credit’s Target Groups: Qualified Summer Youth Employee

- Work Opportunity Tax Credit Statistics for Ohio

- #ICYMI

CMS’s Brian Kelly Featured on the Sage Thought Leadership Podcast

Cost Management Services’ Brian Kelly was recently featured on the Sage Thought Leadership Podcast hosted by Ed Kless. Brian discusses the benefits of the Work Opportunity Tax Credit program.

IRS Encourages Employers to Take Advantage of Work Opportunity Tax Credit

The Internal Revenue Service reminds employers to check out a valuable tax credit available to them for hiring long-term unemployment recipients and other groups of workers facing significant barriers to employment.

Why You Should Switch to a Paperless WOTC Screening Process

CMS’s online web link screening system screens your WOTC new hires with ease. The benefits of using the online screening system includes…

WOTC Wednesday: What is a Conditional Certification for the Work Opportunity Tax Credit?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday. Follow us on our new TikTok.

Other Recent #WOTCWednesday Questions Answered:

Submit your question for Brian here.

Understanding the Work Opportunity Tax Credit’s Target Groups: Qualified Summer Youth Employee

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #6 is the Qualified Summer Youth. 1,115 individuals were hired with certification from this target group in 2022, 0.04% of the total.

A “qualified summer youth employee” is one who:

- Is at least 16 years old, but under 18 on the hiring date or on May 1, whichever is later

- Only performs services for the employer between May 1 and September 15 (was not employed prior to May 1) and

- Resides in an Empowerment Zone (EZ)

Texas hired the most qualified Summer Youth employees last year with 318 new hires qualifying under that target group. The maximum tax credit available for hiring a qualified Summer Youth employee is $1,200.

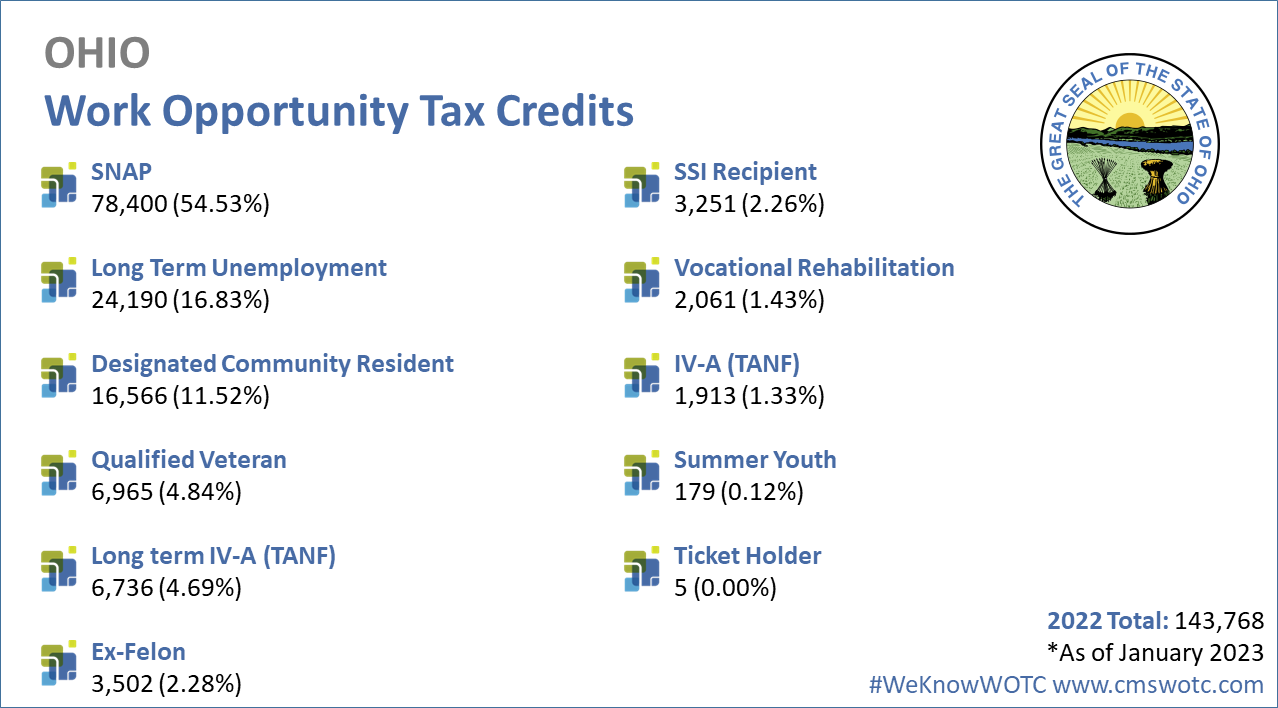

Work Opportunity Tax Credit Statistics for Ohio

In 2022 the state of Ohio issued 143,768 Work Opportunity Tax Credit certifications. Ohio issued 5.59% of WOTC Tax Credits in 2022. SNAP Recipient was Ohio’s highest tax credit target group with 54.53% of certifications for that category. See historical data on Ohio and the Work Opportunity Tax Credit.

#ICYMI

-

- Your WOTC Dashboard

- New Spanish Language Option Available Online

- IRS Encourages Employers to Take Advantage of Work Opportunity Tax Credit

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- WOTC’s Target Groups

- Calculate your WOTC Savings

- Tips to Maximize WOTC Participation and Increase Savings

- The Work Opportunity Tax Credit (WOTC) Statistics 2022

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive