CMS Work Opportunity Tax Credit Newsletter March 2022

In this issue:

- WOTC In The News Roundup

- Tips to Maximize WOTC Participation and Increase Savings

- WOTC Wednesday: Can I Get a WOTC Tax Credit for Hiring a Former Employee?

- Understanding WOTC’s Target Groups: Qualified Veteran

- Work Opportunity Tax Credit Statistics for Nevada

- Switch To Paperless WOTC Screening

- #ICYMI

WOTC In The News Roundup

This article provides a roundup of recent news stories related to the Work Opportunity Tax Credit.

Tips to Maximize WOTC Participation and Increase Savings

With 25 years of experience in Work Opportunity Tax Credit screening and processing, we would like to offer you some tips to make sure you get the maximum tax credit available in 2022.

WOTC Wednesday: Can I Get a WOTC Tax Credit for Hiring a Former Employee?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday.

Other Recent #WOTCWednesday Questions Answered:

- Do Training Hours Count Towards WOTC Tax Credits?

- Are Salaried or Exempt Employees Eligible for the WOTC Program?

- Can I Use WOTC Forms That Were Never Submitted?

Understanding WOTC’s Target Groups: Qualified Veteran

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #3 is the Qualified Veteran. 101,806 individuals were hired with certification from this group in 2021, 4.89% of the total, making it the third overall certified category.

A “qualified veteran” is a veteran who is any of the following:

-

- A member of a family receiving assistance under the Supplemental Nutrition Assistance Program (SNAP) (food stamps) for at least 3 months during the first 15 months of employment.

- Unemployed for a period totaling at least 4 weeks (whether or not consecutive) but less than 6 months in the 1-year period ending on the hiring date.

- Unemployed for a period totaling at least 6 months (whether or not consecutive) in the 1-year period ending on the hiring date.

- A disabled veteran entitled to compensation for a service-connected disability hired not more than one year after being discharged or released from active duty in the U.S. Armed Forces.

- A disabled veteran entitled to compensation for a service-connected disability who is unemployed for a period totaling at least six months (whether or not consecutive) in the one-year period ending on the hiring date.

The maximum tax credit available for hiring a Qualified Veteran is $9,600. The actual amount will vary depending on the qualifying target group.

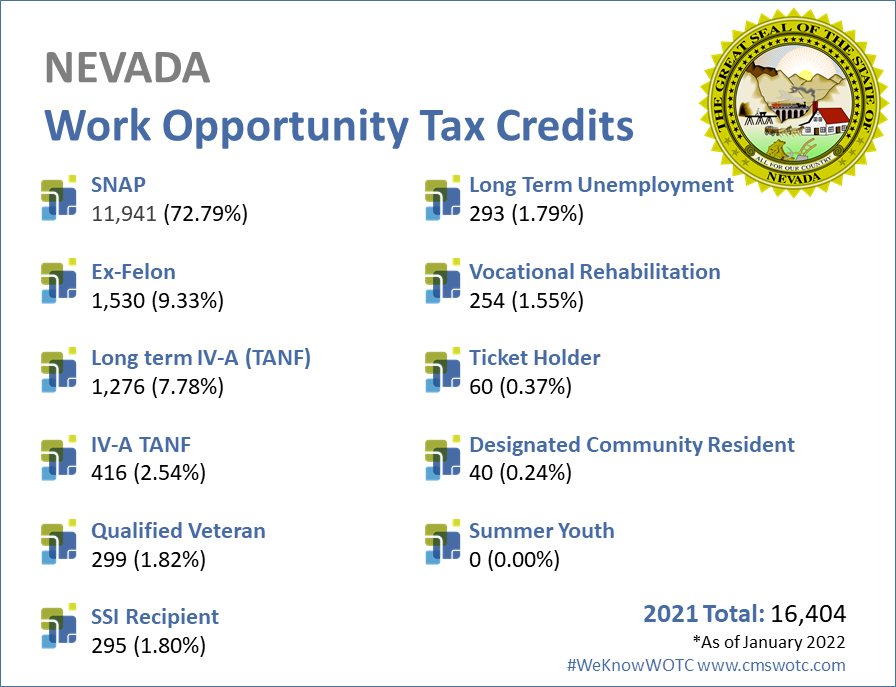

Work Opportunity Tax Credit Statistics for Nevada

In 2021 the state of Nevada issued 16,404 Work Opportunity Tax Credit certifications. Nevada issued 0.79% of all WOTC Tax Credits in 2021, SNAP was Nevada’s highest tax credit category with 72.79% of certifications for that category.

Switch to Paperless WOTC Screening

CMS has been providing Work Opportunity Tax Credit screening services for 25 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

-

- Your WOTC Dashboard

- New Spanish Language Option Available Online

- Work Opportunity Tax Credit By The Numbers 2020

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- Important Notice: URL Changes for Online WOTC Forms

- Four Things You Didn’t Know About the Work Opportunity Tax Credit

- WOTC’s Target Groups

- Calculate your WOTC Savings

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive