>

CMS Work Opportunity Tax Credit Newsletter May 2023

In this issue:

- How Many Veterans Are Hired Each Year That Qualified for WOTC? & Where to Post Jobs to Attract Applications from U.S. Veterans

- CMS Pin Point WOTC Technology (CPPT)

- Why You Should Switch to a Paperless WOTC Screening Process

- WOTC Wednesday: Best Practice to Make Sure All Employees Participate

- Understanding the Work Opportunity Tax Credit’s Target Groups: Vocational Rehabilitation Referral and Ticket to Work

- Work Opportunity Tax Credit Statistics for Kansas

- #ICYMI

How Many Veterans Are Hired Each Year That Qualified for WOTC? & Where to Post Jobs to Attract Applications from U.S. Veterans

According to Monster.com 90% of veterans say finding a veteran-friendly company is critical in their job search. And when you are using the Work Opportunity Tax Credit, you may also be eligible for a tax credit of up to $9,600.

CMS Pin Point WOTC Technology (CPPT)

CMS’s Pin Point WOTC Technology (CPPT) performs a multi-step process to detect, identify and confirm new hires living in Federal Empowerment Zones and Rural Renewal Communities. CMS provides another technology tool designed to maximize the federal tax credit program for our clients.

Why You Should Switch to a Paperless WOTC Screening Process

CMS’s online web link screening system screens your WOTC new hires with ease. The benefits of using the online screening system include…

WOTC Wednesday: Best Practice to Make Sure All Employees Participate

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday. Follow us on our new TikTok.

Other Recent #WOTCWednesday Questions Answered:

Submit your question for Brian here.

Understanding the Work Opportunity Tax Credit’s Target Groups: Vocational Rehabilitation Referral and Ticket to Work

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #5 is the Vocational Rehabilitation Referral. 28,566 individuals were hired with certification from this target group in 2022, 1.1 of the total. This category is also combined with “Ticket to Work” or “Ticket Holder” which received 3,481 certifications in 2022.

A qualified “Vocational rehabilitation referral” is a person who has a physical or mental disability and has been referred to the employer while receiving or upon completion of rehabilitative services pursuant to:

- A state plan approved under the Rehabilitation Act of 1973 OR

- An Employment Network Plan under the Ticket to Work program, OR

- A program carried out under the Department of Veteran Affairs.

Texas hired the most vocational rehabilitation referrals last year with 5,748 new hires qualifying under that target group. Massachusetts hired the most Ticket to Work holders at 516. The maximum tax credit available for hiring a qualified Vocational Rehabilitation Referral/Ticket to Work is $2,400.

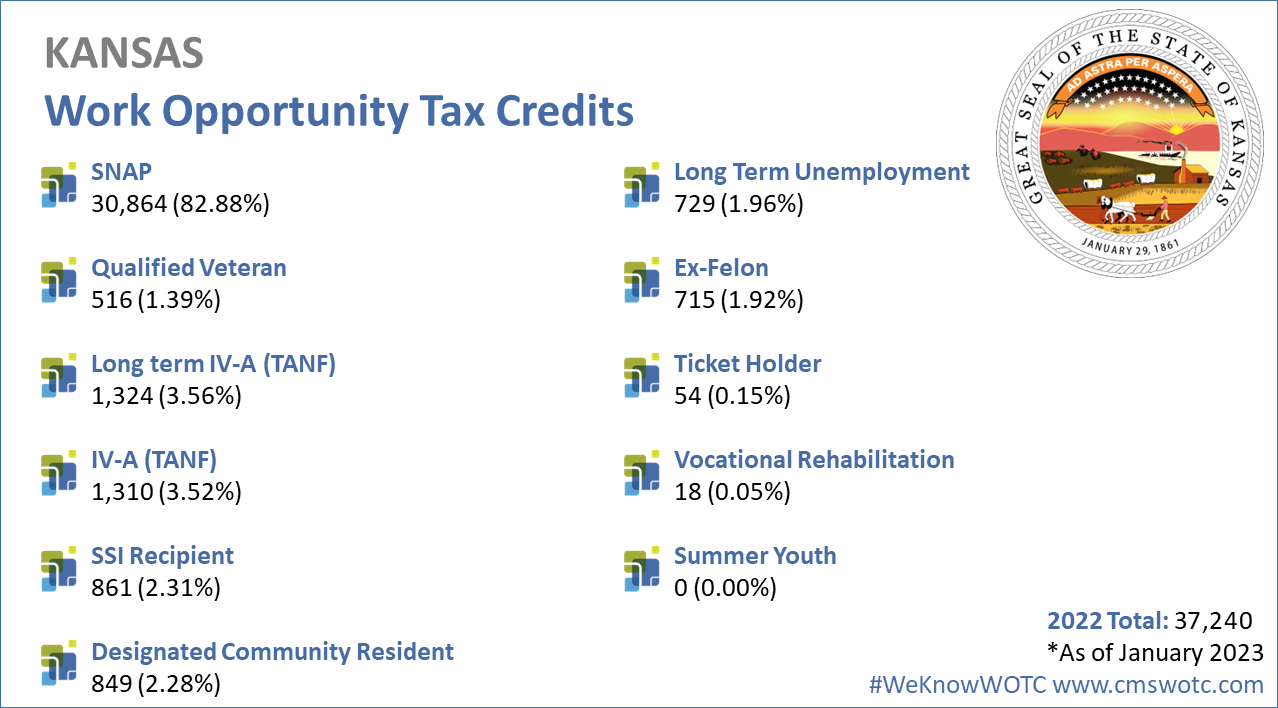

Work Opportunity Tax Credit Statistics for Kansas

In 2022 the state of Kansas issued 37,240 Work Opportunity Tax Credit certifications. Kansas issued 1.45% of WOTC Tax Credits in 2022. SNAP Recipient was Kansas’ highest tax credit target group with 82.88% of certifications for that category. See historical data on Kansas and the Work Opportunity Tax Credit.

#ICYMI

-

- Your WOTC Dashboard

- New Spanish Language Option Available Online

- IRS Encourages Employers to Take Advantage of Work Opportunity Tax Credit

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- WOTC’s Target Groups

- Calculate your WOTC Savings

- Tips to Maximize WOTC Participation and Increase Savings

- The Work Opportunity Tax Credit (WOTC) Statistics 2022

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive