CMS Work Opportunity Tax Credit Newsletter October 2023

In this issue:

- CMS WOTC Screening Services

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- WOTC Wednesday: When Is The Best Time To Give the Applicant the Work Opportunity Tax Credit Survey?

- Understanding the Work Opportunity Tax Credit’s Target Groups: Qualified Long-Term Unemployment Recipient

- Work Opportunity Tax Credit Statistics for Mississippi

- #ICYMI

CMS WOTC Screening Services

Share this video with your colleagues, or anyone who needs to get up-to-speed on the Work Opportunity Tax Credit.

EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

Per the EEOC: Our position has not changed, and we continue to advise that proper employer use of Form 8850 would not violate the federal equal employment opportunity (EEO) laws, most prominently Title I of the Americans with Disabilities Act.

WOTC Wednesday: When Is The Best Time To Give the Applicant the Work Opportunity Tax Credit Survey?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday. Follow us on our new TikTok.

Other Recent #WOTCWednesday Questions Answered:

Submit your question for Brian here.

Understanding the Work Opportunity Tax Credit’s Target Groups: Qualified Long-Term Unemployment Recipient

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #10 is the Qualified Long-Term Unemployment Recipient. 410,015 individuals were hired with certification from this target group in 2022, 15.96% of the total.

A “qualified long-term unemployment recipient” is an individual who has been unemployed for not less than 27 consecutive weeks at the time of hiring and who received unemployment compensation during some or all of the unemployment period.

California hired the most Long-Term Unemployment Recipients last year with 65795 new hires qualifying under that target group. The maximum tax credit available for hiring a Qualified Long-Term Unemployment Recipient is $2,400.

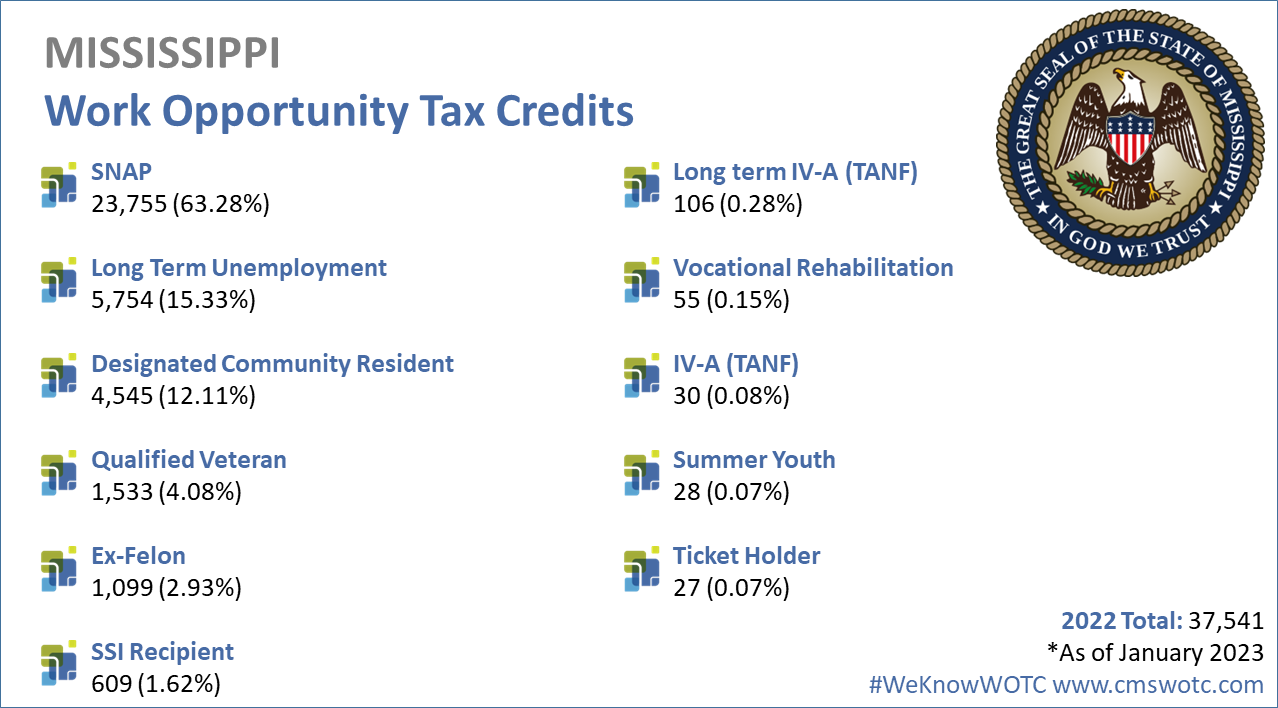

In 2022 the state of Mississippi issued 37,541 Work Opportunity Tax Credit certifications. Mississippi issued 1.46% of WOTC Tax Credits in 2022. SNAP Recipient was Mississippi’s highest tax credit target group with 63.28% of certifications for that category. See historical data on Mississippi and the Work Opportunity Tax Credit.

#ICYMI

-

- Your WOTC Dashboard

- New Spanish Language Option Available Online

- IRS Encourages Employers to Take Advantage of Work Opportunity Tax Credit

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- WOTC’s Target Groups

- Calculate your WOTC Savings

- Tips to Maximize WOTC Participation and Increase Savings

- The Work Opportunity Tax Credit (WOTC) Statistics 2022

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive