State On Pace to Possibly Double Number of Tax Credits Approved in 2016

The Tennessee Department of Labor and Workforce Development (TDLWD) Commissioner Burns Phillips announced yesterday that the department’s Workforce Services Division marked a milestone in June after issuing more than $215 million of Work Opportunity Tax Credits (WOTC) to employers across the state.

2017 is on pace to be a record-breaking year for the WOTC program in Tennessee. During the first six months of 2017, TDLWD received 162,795 WOTC applications and approved 83,385 of them (51%), totaling $215,445,800 in tax credits for employers. This provided employers of an average $2,583 per qualified new hire.

“The amount of funding the Work Opportunity Tax Credit offers Tennessee employers can be of an enormous benefit to a company’s financial situation, while at the same time helping an individual who is struggling to find meaningful employment. It is truly a great program,” said Commissioner Phillips.

The number of eligible applications approved by TDLWD between January and June 2017 is just over 2,000 fewer applications then the total of all approved applications in 2016. Just six months into 2017 and the TDLWD has already awarded $5 million more in tax credits than the 12-month total for 2016.

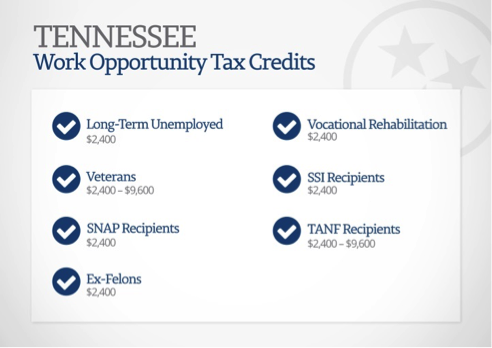

The WOTC provides federal tax credit incentives to employers who hire eligible individuals. A company can receive a tax credit that ranges from $1,500-$9,600 per approved employee.

How Much We Save Employers

CMS has worked with WOTC since 1997, and we have found over the years that on average 10-15% of all new employees can fall into one of the tax credit categories that qualify for a tax credit. The average credit received is between $1,500 – $9,600 per qualified new hire depending on the target group. Some of our customers have saved a phenomenal $100,000 in a single year.

How Much Can We Save You?

To find out your potential savings, please see our WOTC Calculator. There’s never been a better time to learn about WOTC. Please contact us at 800-517-9099 to speak to a Work Opportunity Tax Credit expert today.