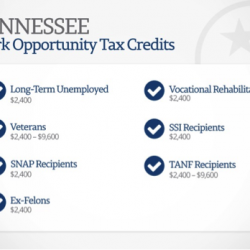

The Work Opportunity Tax Credit (WOTC) in Tennessee

Did you know that last year the state of Tennessee issued 71,763 Work Opportunity Tax Credit certifications? The Work Opportunity Tax Credit, known as WOTC, is a federal tax incentive designed to help people with barriers to employment into the workplace. By hiring someone from a Target Group, your company may be eligible for a tax credit[…]