WOTC Certifications Issued by Target Group 2002-2014

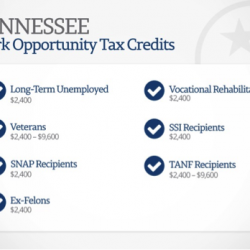

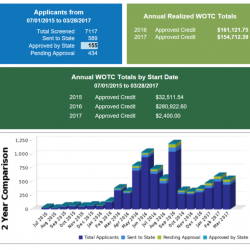

Work Opportunity Tax Credit historical data and statistics, listed by Target Group. What this data shows us, is not just the increases or decreases in participation, this shows how the changes in the economy over time and how this leads to a need for newly created or expired target groups. This shows how much money[…]